VAT Policy

This VAT policy outlines how Value Added Tax (VAT) is applied to purchases made via growingpaper.com. As a Dutch company, Growingpaper B.V. is subject to Dutch and EU VAT regulations. The policy applies to all private and business customers ordering from countries within and outside the European Union.

VAT Within the European Union (EU)

Private customers (B2C)

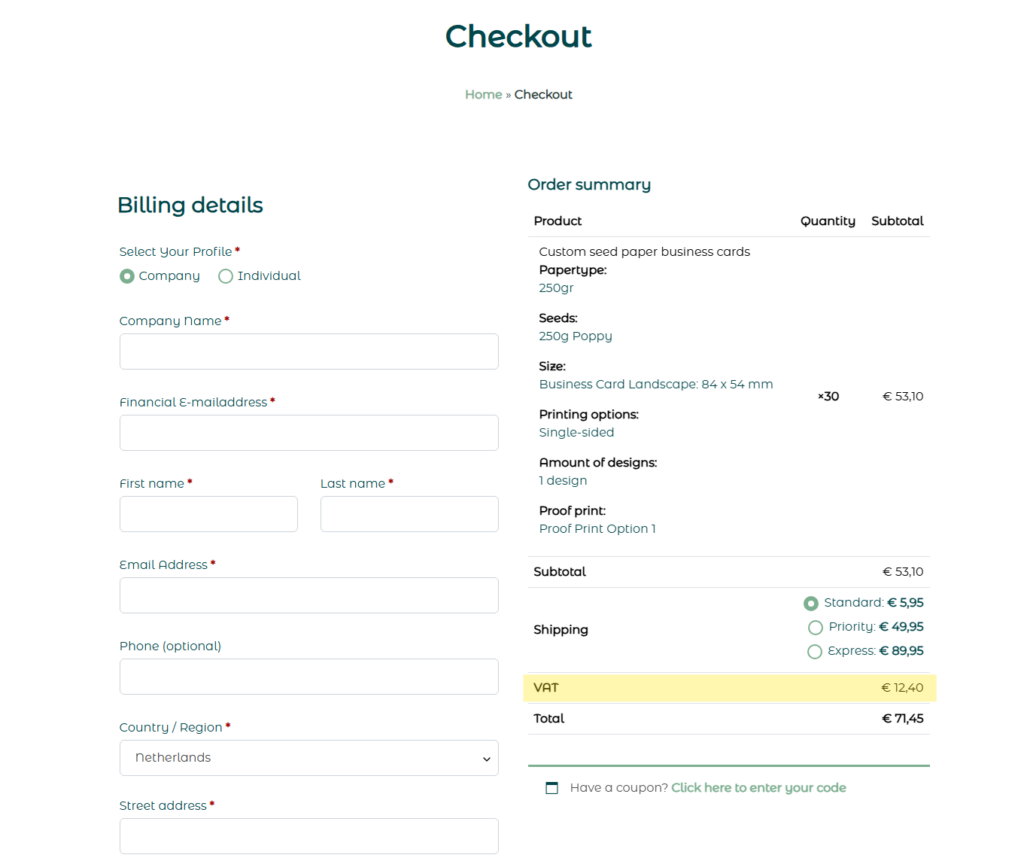

Orders placed by private individuals in EU countries are subject to local VAT. The applicable VAT rate is based on the destination country and is automatically calculated during checkout.

Business customers (B2B)

Business customers within the EU who provide a valid VAT number (verified via the VIES system) can order VAT-free under the reverse charge mechanism. The VAT number must be entered correctly during the order process.

If no valid VAT number is provided, VAT will be charged according to the applicable rate in the destination country.

VAT Outside the EU

Orders shipped to countries outside the European Union are not subject to Dutch VAT. However, local import duties, taxes, and customs fees may apply in the destination country. These costs are the responsibility of the customer and are not included in the product price or shipping cost.

VAT on Digital Invoices

All invoices include detailed VAT information, such as:

- The VAT rate

- The VAT amount

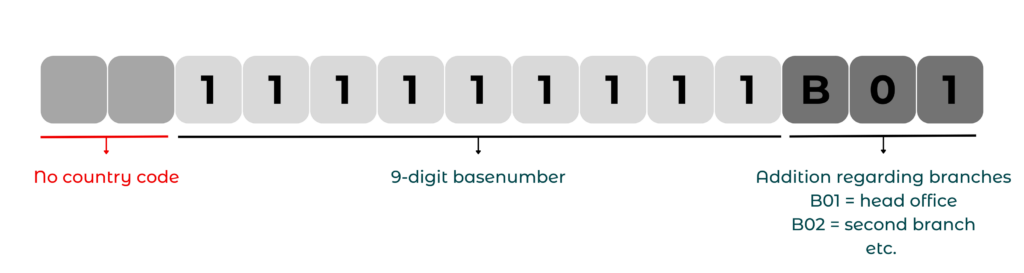

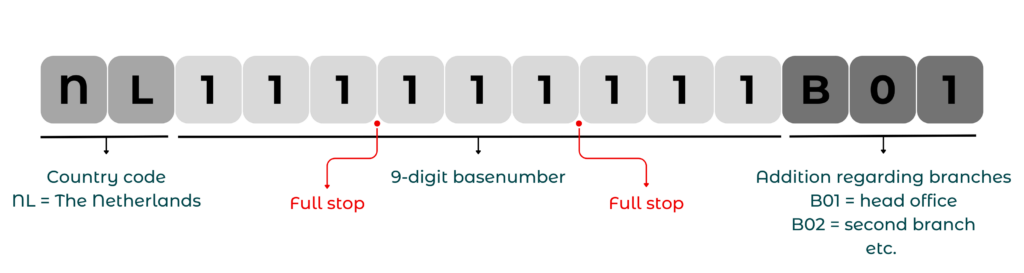

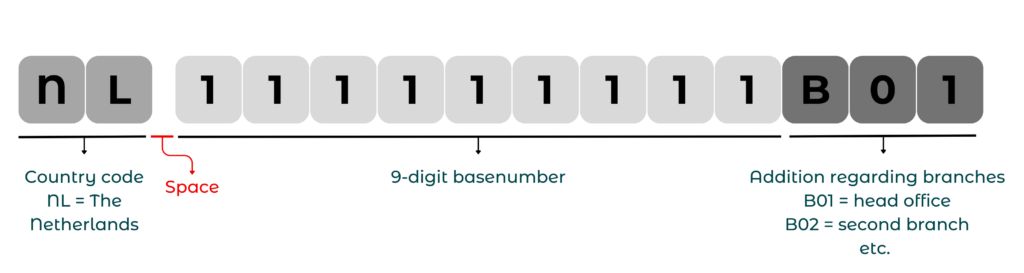

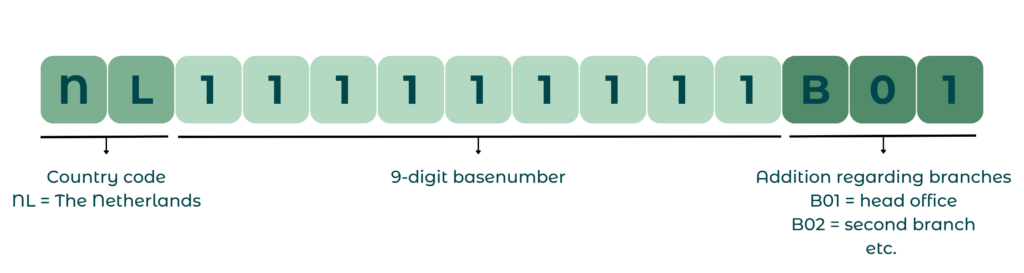

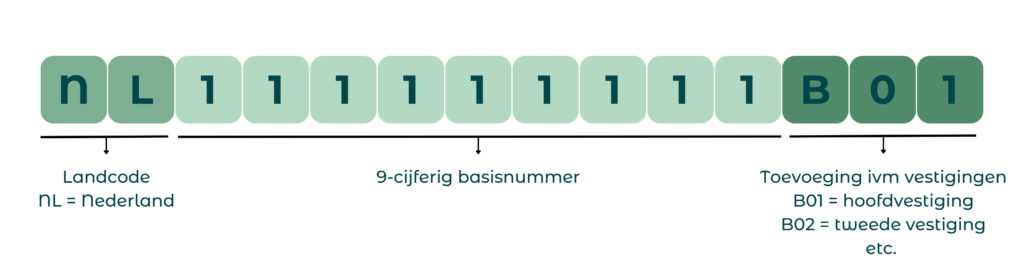

- The Growingpaper VAT ID: NL861826814B01

Invoices are sent automatically via email after the order has been processed.

Questions or special VAT cases?

For questions regarding VAT treatment, specific business orders, or export-related issues, please contact our support team at info@growingpaper.nl or via our Contact & Support page.

VAT number look per country

*This might look different for countries outside of the Netherlands. Make sure to double-check the way a VAT number should look for your country.

Incorrect VAT numbers